Companies with a long-term IT digital strategy that involves rapid growth and innovation often look to large ERP vendors, like SAP, Oracle and other Tier I vendors. This is not surprising. After all, one advantage large vendors have over smaller vendors is other applications in their portfolio that complement their main ERP system.

This may be an artificial intelligence (AI) solution that can analyze a massive amount of data, or an IoT solution that assists in the efficient picking and packing of products. If you’re interested in such applications, then you’ve probably been searching for articles about SAP vs. Oracle.

This is one of those articles. However, it’s not like most SAP vs. Oracle articles – this article is based on our experts’ hands-on experience with a variety of these vendors’ products. It’s also based on our benchmark data gathered from companies across industries and locations.

A Brief Overview of SAP vs. Oracle

Clients often ask us, “which is the better ERP software system?” Of course, as an independent ERP consultant, we determine the best fit for our clients based on their unique business requirements. However, we’d still like to provide a comparison of SAP and Oracle.

Who is SAP?

SAP primarily builds its products from the ground up rather than through acquisition. We’ve found that SAP ERP software has deep functionality, so it requires a very technical, time-consuming implementation.

In addition to Clash of the Titans, SAP was featured in our Top 10 ERP Systems Report. This report highlights vendors of all sizes that we believe are viable vendors with strong functionality.

Some of the SAP systems we included in our Top 10 ERP Systems Report included S/4HANA, SAP Business One and SAP Business ByDesign.

SAP S/4HANA is designed for large, enterprise organizations, and has strong capabilities across all functional areas. For example, S/4HANA Cash Application enables real time, intelligent invoice-matching powered by machine learning.

SAP Business One and SAP Business ByDesign are designed for the small and midmarket. They provide comprehensive solutions for financials, sales, operations and customer relations.

SAP ECC was not included in our report because SAP will be ending support for the product in 2025.

Who is Oracle?

Oracle’s primary strength is acquiring product lines that can provide flexible functionality to a variety of industry niches. In 2016, they purchased ERP vendor, NetSuite. Oracle and NetSuite continue to gain benefits from their merger. For example, NetSuite has improved Oracle’s SaaS ERP offerings.

One area of struggle that Oracle has experienced is quickly transitioning niche functionality from EBS and JD Edwards into Oracle’s newer products, like Oracle Cloud ERP (this was the product we featured in our Top 10 ERP Systems Report). Oracle Cloud ERP is designed for large, enterprise organizations with many functional areas. While it is a relatively new product, it is continuing to gain market share as well as enrich and build functionality.

Oracle EBS and Oracle JDE are both sunsetting. To learn more about what “sunsetting” means and what it specifically means for Oracle JDE, read our blog post, Oracle’s Shift in Focus: From Oracle JDE to Oracle Cloud Applications.

2025 Clash of the Titans

SAP, Oracle, Microsoft, and Infor each have a variety of systems that can support data-driven decision-making. We surveyed customers of these four vendors to find out what their selection and implementation process was like.

Panorama Client Experience: The Difference Between SAP and Oracle

Based on our experience evaluating and implementing ERP solutions for clients, we’ve gleaned some interesting insights about the difference between SAP and Oracle:

1. Demo Scores

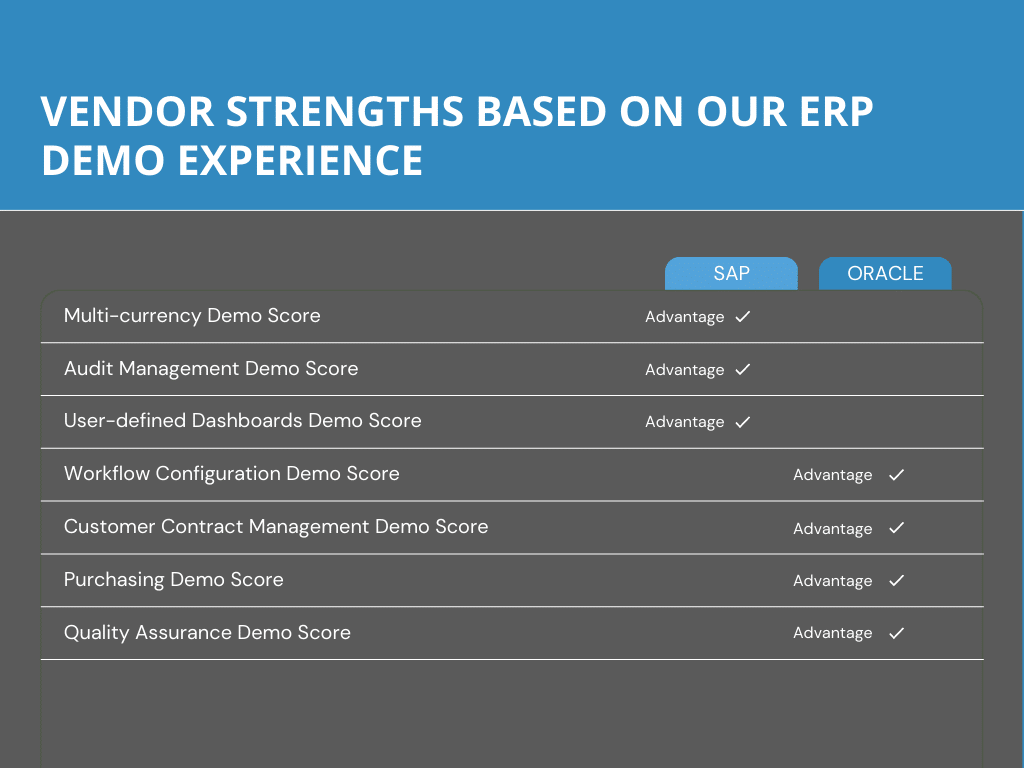

We regularly coordinate ERP vendor demonstrations for clients. After each demo, clients score functionality on a scale from 1 to 5. The highest score a vendor can receive is a 5. The following metrics are a combined average based on clients’ recent ratings of SAP and Oracle across a variety of products:

SAP and Oracle Products Scored Closely in These Areas

Demand Forecasting – (SAP) 2.3 / (Oracle) 2.2

Industry Intelligence – IBM partnered with SAP to create a Cognitive Demand Forecasting Solution for the retail industry. The solution can be integrated into SAP S/4HANA and the SAP Customer Activity Repository. Oracle Demand Management Cloud is a supply chain management solution that accurately predicts customer demand for a broad range of industries.

Material Requirements Planning – (SAP) 1.8 / (Oracle) 1.9

Industry Intelligence – While these may seem like low scores, this was before SAP’s recent updates to its material requirements planning (MRP) capabilities within SAP S/4HANA. Oracle NetSuite also has recent updates to its MRP.

Fixed Asset Management – (SAP) 3.3 / (Oracle) 3.3

Industry Intelligence – SAP Business One has a fixed asset management function that eliminates the need for repetitive manual data entry. Oracle NetSuite Fixed Asset Management automates asset acquisition, depreciation, revaluation and retirement.

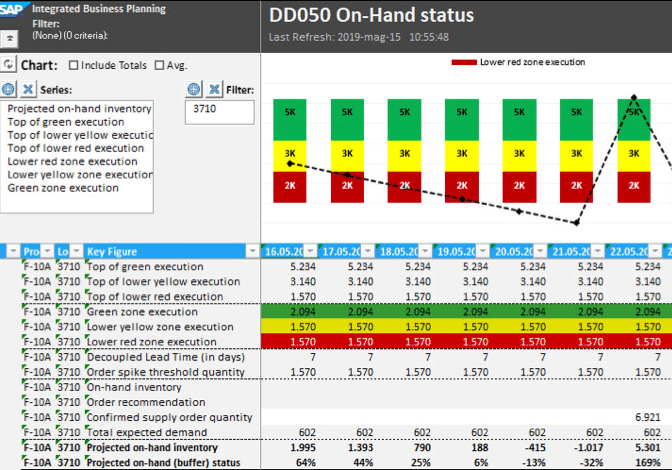

eCommerce – (SAP) 2.2 / (Oracle) 2.2

Industry Intelligence – SAP Upscale Commerce allows manufacturers and merchants to quickly launch “pop-up” ecommerce stores. Oracle Commerce On-premise, has likely stopped releasing updates. However, Oracle Commerce Cloud is frequently updated, with its last update this month.

If you’re evaluating eCommerce systems, be sure to check out our blog, 5 Tips for Selecting an eCommerce System.

SAP Products Scored Higher in These Areas

Audit Management – (SAP) 3.8 / (Oracle) 3.4

Industry Intelligence – SAP Audit Management instantly captures audit documentation while providing drag-and-drop tools. You can access the application through mobile devices.

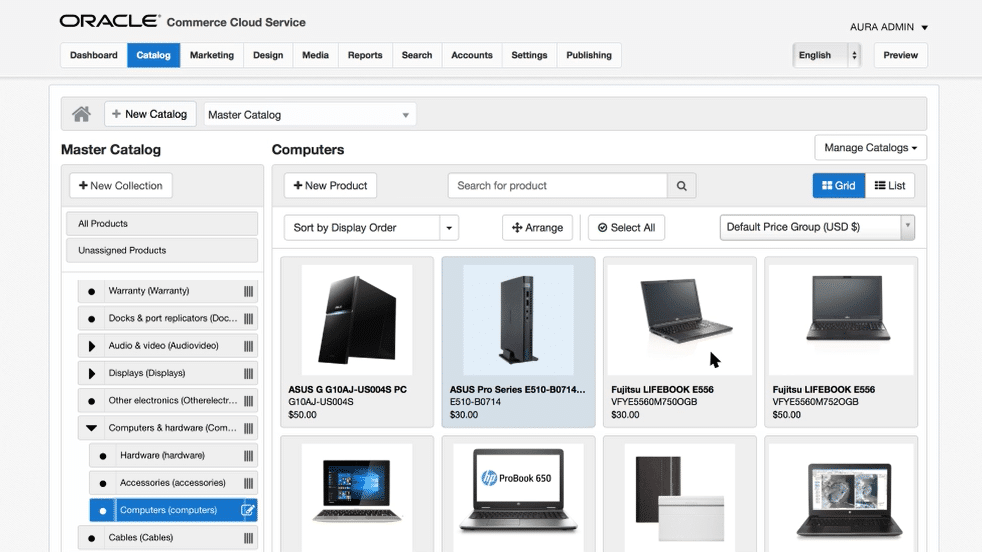

User-Defined Dashboards – (SAP) 3.9 / (Oracle) 1.4

Industry Intelligence – Not all BI vendors provide user-friendly dashboards. However, SAP BusinessObjects allows you to create interactive, role-based dashboards accessible from any device. An alternative is SAP Analytics Cloud, which allows you to easily create predictive models and integrate them into workflows.

Oracle Products Scored Higher in These Areas

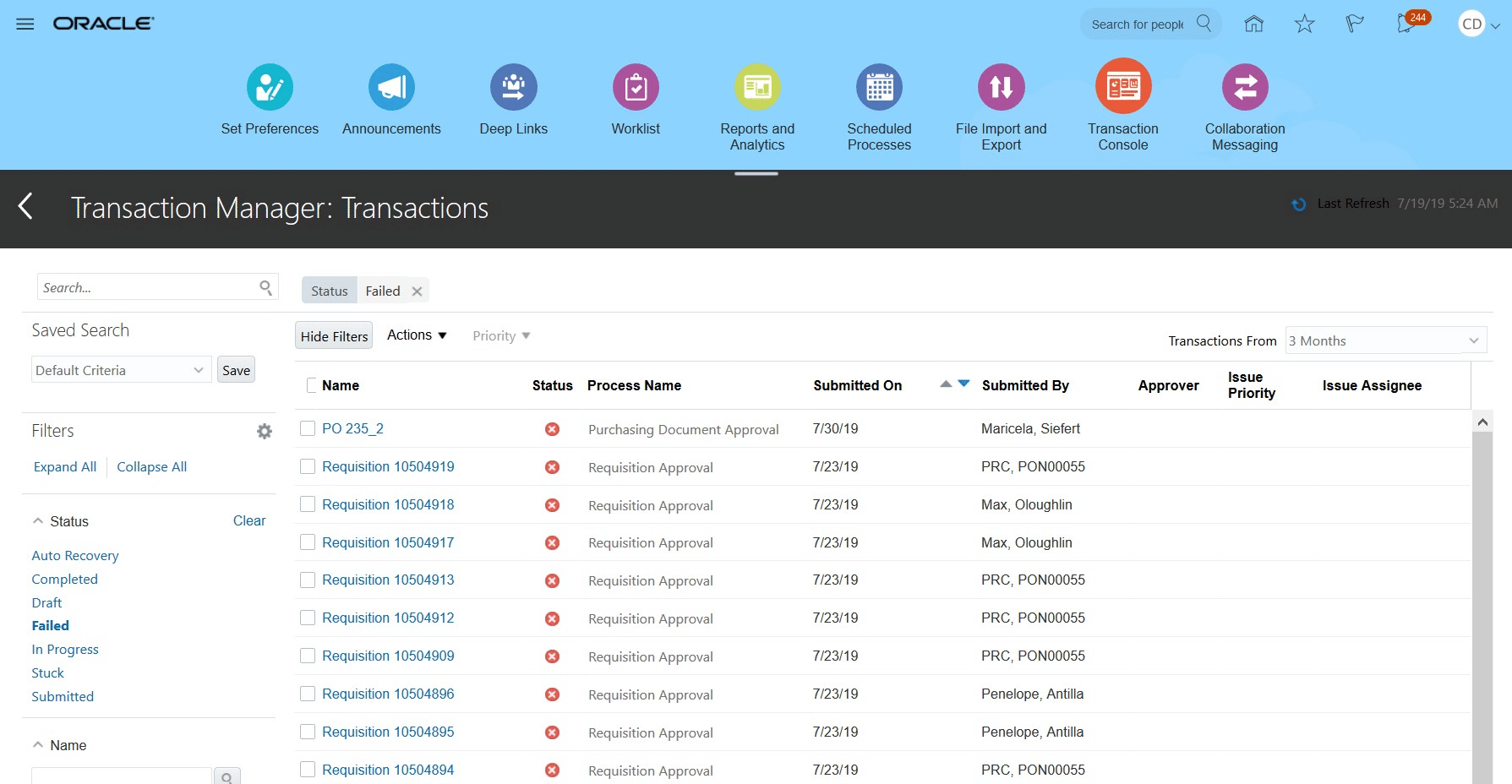

Workflow Configuration – (SAP) 2.9 / (Oracle) 3.3

Industry Intelligence – Oracle has a new set of artificial intelligence applications that automate processes within its cloud suite.

Customer Contract Management – (SAP) 3.0 / (Oracle) 3.7

Industry Intelligence – Oracle Project Contract Billing Cloud provides pre-built templates and automates project billing. The application ensures contracts are compliant with project billing requirements.

Purchasing – (SAP) 2.8 / (Oracle) 3.3

Industry Intelligence – Oracle Purchasing Cloud automates routine transactions, such as invoice validation. The application fully integrates with accounts payable modules.

Quality Assurance – (SAP) 2.1 / (Oracle) 3.1

Industry Intelligence – Oracle Product Lifecycle Management Cloud allows you to define inspection plans by connecting product design standards and quality specifications.

While the above scores are just averages of more detailed metrics, they show the strengths and weaknesses of each ERP system. Demo scores are one of several factors to consider during an evaluation of SAP and Oracle.

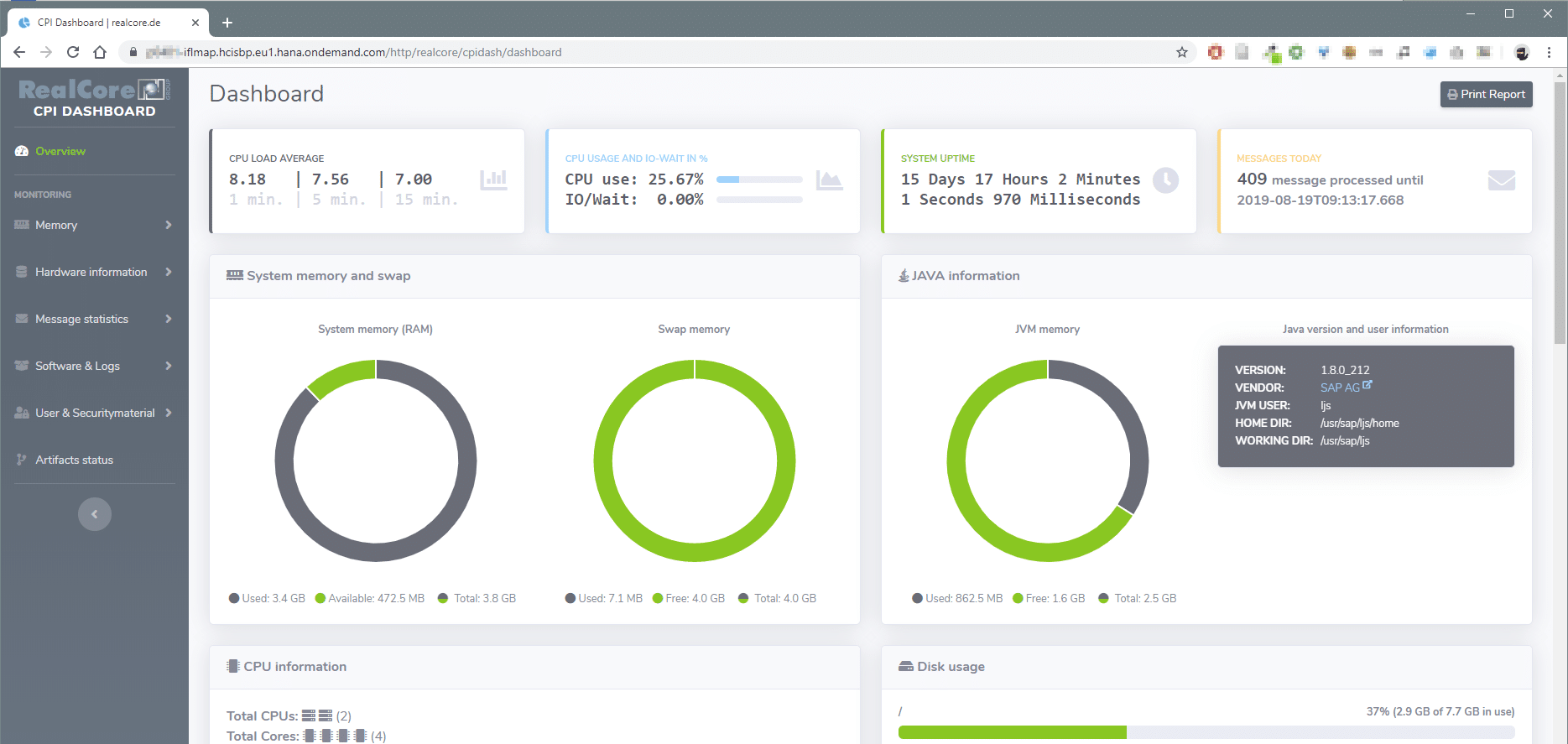

2. Deployment and Hosting Options

SAP and Oracle both have products with multiple hosting and deployment options. They typically encourage our clients to consider cloud-based technology even if they’ve expressed interest in on-premise technology.

Focusing on cloud ERP is a smart move for SAP and Oracle as the market is increasingly demanding flexible hosting and deployment options. While many companies are excited about the cloud, they are still a bit cautious.

Case in point: We’ve found that neither SAP nor Oracle have very many references for cloud implementations at large, complex companies. This indicates that most large companies are not moving to the cloud, and the lack of references gives them one more reason not to. It’s a viscous cycle.

While ERP vendors have done a good job from a marketing and a sales perspective, when you start actually implementing these applications, you have to consider integrations, and that’s a nightmare for many vendors.

Nevertheless, SAP and Oracle are working hard to improve their cloud platforms. For example, Microsoft Azure was recently selected as an SAP preferred partner to ease customers’ transition to SAP S/4HANA and the SAP Cloud Platform.

In addition, Oracle continues to release quarterly updates to its cloud solution, bringing new features and functionality, such as the Oracle Cloud Data Science Platform. This service makes it quick and easy for companies to build and deploy machine learning models.

3. Vendor Viability

While SAP and Oracle aren’t likely to go out of business any time soon, they occasionally discontinue certain products.

SAP S/4HANA is a relatively new platform for SAP. The product has strong R&D funding as does Oracle ERP Cloud. However, R&D spending on Oracle EBS on-premise, is waning as the product is moving exclusively to the cloud. It’s difficult to find technical resources to implement EBS on-premise – most Oracle system integrators are focused on the cloud.

While many produce phase-outs are confirmed, others aren’t. If rumors are going around that a product is sunsetting, these may be just rumors. The story below is a good illustration of this:

The Long and Winding Road of SAP Business ByDesign

In 2014, there was much talk of SAP Business ByDesign being phased out. At the time, NetSuite created a bit of controversy by offering SAP customers a migration path from SAP Business ByDesign to its own flagship product targeting the small and mid-market.

This in and of itself might not have been that controversial, except for the fact that the SaaS ERP vendor issued the press release under the pretext of SAP customers needing a migration path since the SAP was allegedly discontinuing the product.

In truth, NetSuite was partially right – ByDesign was struggling to gain traction. Despite spending three billion Euros developing the product over seven years, it hadn’t gained much market traction – roughly 800 customers and 23 million Euros in annual revenue. In response, SAP cut R&D funding for the product and shifted their focus to its HANA platform.

Fast forward to today, and SAP Business ByDesign is now profitable and a popular solution for the midmarket. From this it is clear that the product is moving toward many of the same innovations found in S/4HANA, such as IIoT and advanced business intelligence.

4. Overall Functionality

This table reveals some of the functional strengths of each vendor based on our ERP demo experience:

Manufacturing Functionality: Oracle ERP Cloud vs. SAP HANA

Oracle ERP Cloud

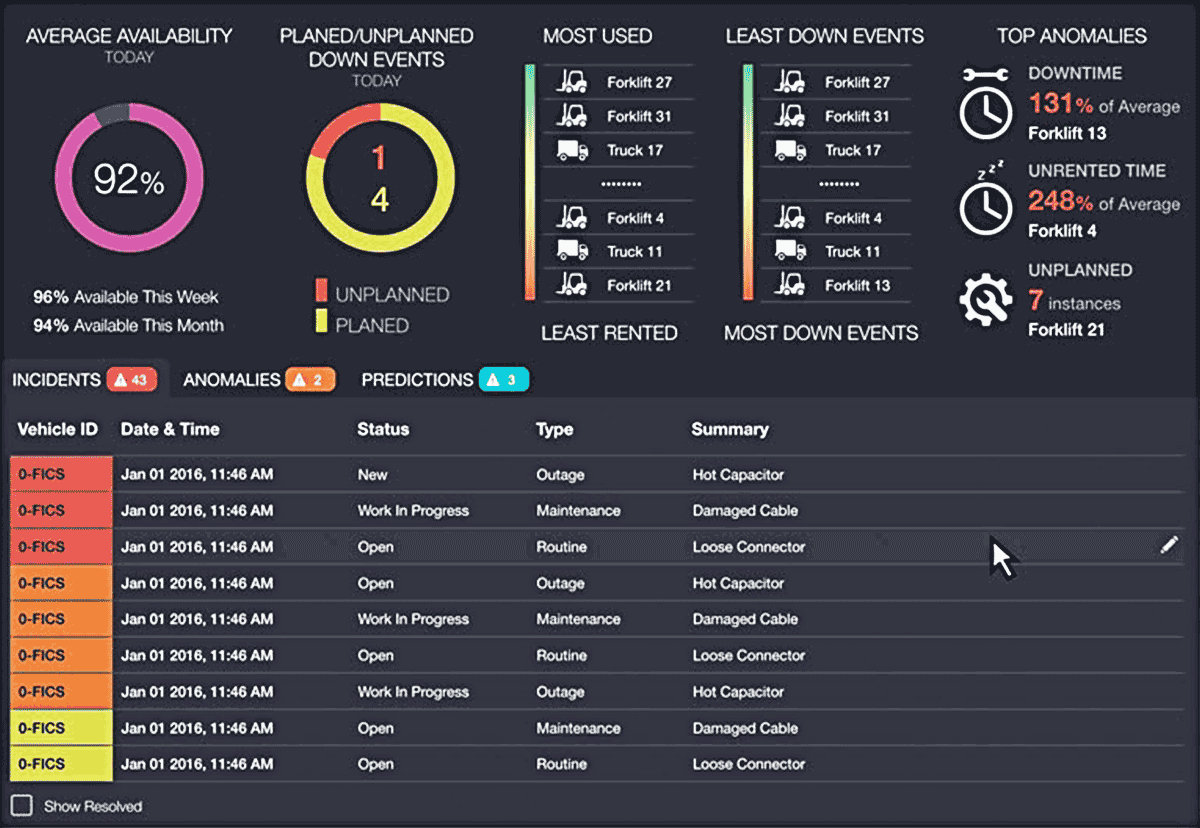

While not all functionality is within the new cloud offering to serve all manufacturing sub-industries, the application does enable real-time production monitoring and equipment monitoring. This enables companies to prevent shop floor issues before they happen.

For example, Oracle’s IoT-enabled equipment solution allows companies to get plant data by accessing the IoT technology on their assets. They also can get extensive drilldowns to find out exactly what is going on in their supply chain facility.

SAP S/4HANA

This system provides digital collaboration capabilities that bridge the gap between engineering and manufacturing.

As one of the leaders in the practical use of AI on the shop floor, SAP is using S/4HANA to make AI in ERP more accessible, and they’re giving tangible evidence of how to use AI with workflow automation and business intelligence.

For example, IoT sensors and other devices can integrate with manufacturing execution system data to generate automated alerts and workflows for corrective action.

In addition, S/4HANA’s machine learning capabilities can develop an understanding of shop floor equipment and help monitor production and safety more efficiently.

Oracle ERP Cloud vs. SAP HANA

These are pretty comparable systems as they are both designed for large enterprises. Oracle ERP Cloud is part of the Oracle Cloud Applications suite. These cloud applications are not as mature as S/4HANA, especially in terms of their ability to serve all manufacturing sub-industries.

However, Oracle ERP Cloud is a strong system in other functional areas as it has led the Magic Quadrant for cloud core financial management suites for large, midsize and global entprises for three years straight.

The Importance of Process Improvement

While many companies implement SAP and Oracle with the intent of improving business processes, they often end up with an ERP solution that replicates their old system’s inefficiencies.

When clients ask us for ERP selection guidance, we always recommend that they look for opportunities for process improvement before evaluating systems. This is essential because a new system will not automatically improve business processes – not even if a company is moving from a legacy system to a modern ERP system.

Once companies have improved their processes, they should invite vendors for on-site discovery, allowing the same amount of time for each of their top vendors to understand their ERP requirements.

Final Thoughts on Oracle vs. SAP

Comparing Oracle and SAP requires an in-depth understanding of software capabilities, deployment options and product viability. An informed decision also requires business process reengineering and requirements definition prior to selection.

Armed with this insight, you can decide whether SAP, Oracle, or another system altogether, best fits your business needs.

If your company is trying to decide between an SAP product and an Oracle product, our ERP consultants can help. Request a free consultation below.