As veterans in the mortgage lending space and as operational efficiency experts, we have seen firsthand the benefits of fully integrated ERP systems. This technology can replace a patchwork of disparate systems to make complex loan processes streamlined, while dramatically improving customer service.

The name of the game in loan process management is to drive down the cost to produce because margins can be thin. Increasing the number of files-to-employee (FTE) efficiency measure, while decreasing loan cycle time and achieving best price execution creates a more profitable lending platform and increases customer satisfaction.

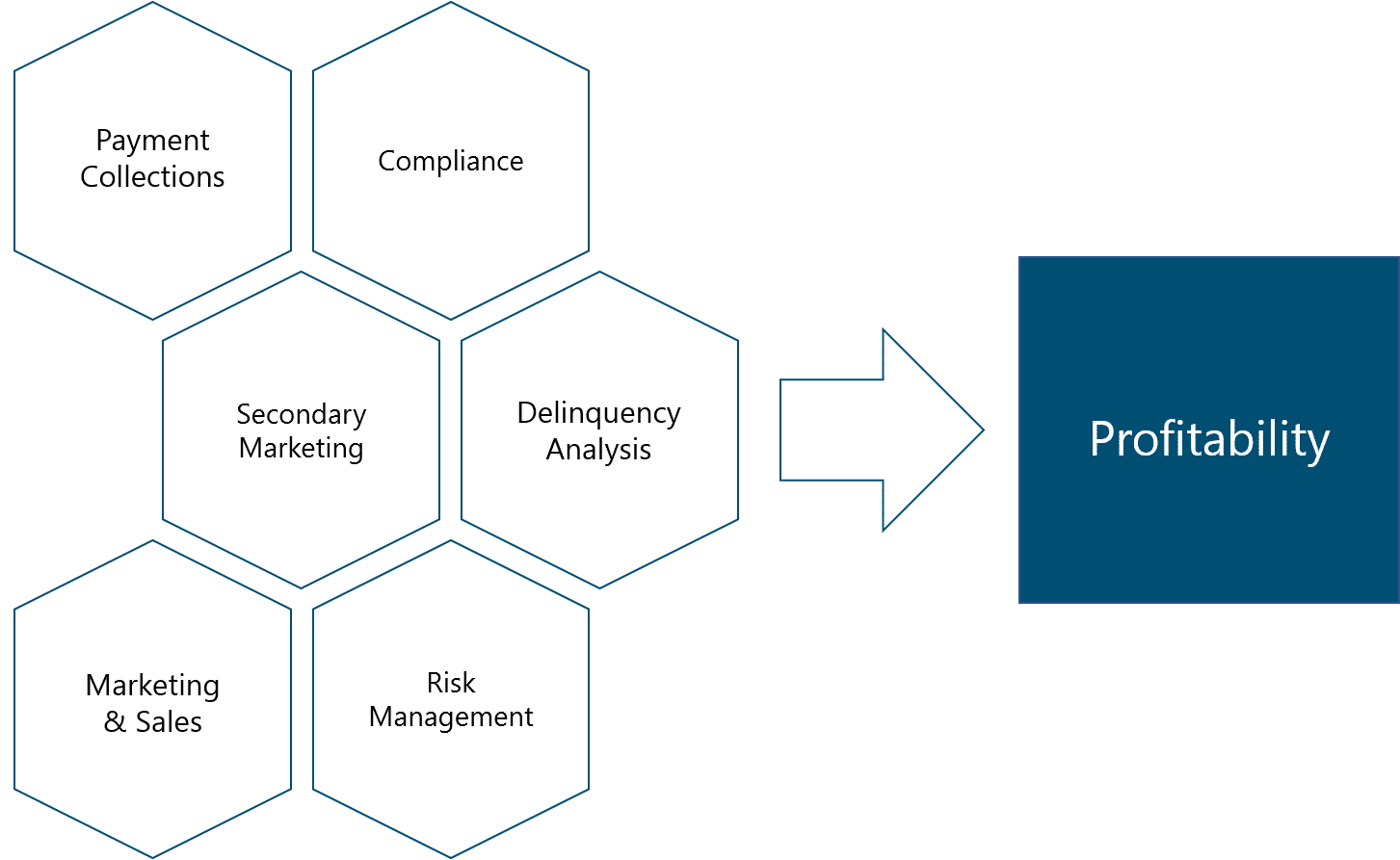

Leveraging industry best practices to incorporate your loan process flow and integrate compliance, secondary marketing, risk management, delinquency analysis, payment collections, marketing and sales into one seamless platform will have a dramatic impact on your profitability.

The Importance of ERP

When we speak of ERP systems, we use it as a general term for a cohesive integration of best-of-breed systems spanning the entire enterprise.

Deployed correctly, an ERP system provides the necessary data management tools to perform actionable data analysis, automate accounting processes and inform predictive analytics for secondary marketing, model repayment and default risk.

An ERP software solution also can improve customer service and optimize what and who you’re marketing to in your customer portfolio. This flexibility is important as changes in interest rates and other macroeconomic factors continuously impact the lending landscape.

Essentially, ERP effectively streamlines lending operations, reducing human error by automating many tasks and considerably reducing a lender’s cost to produce.

ERP is for All Types of Lenders

We have worked with many types of lenders, from federal and state-chartered banks and credit unions to retail mortgage bankers with call center origination channels. This includes traditional brick-and-mortar retail lending operations, wholesale and correspondent mortgage lenders, and even B2B “FinTech” (Financial Technology) companies.

Based on this experience, we are here to tell you that the next iteration of successful lenders will be those who can effectively automate to increase their FTE efficiency measure, decrease their loan cycle time and achieve best price execution.

Lending is a commodity business, and after all is said and done, borrowers want the best terms, the lowest rates and the fastest and least painful borrowing experience.

10 Benefits of ERP for Lenders

1. ERP Consolidates Disparate Systems

An ERP system can bring a lender’s disparate technology applications into one integrated system with a single source of truth (consolidated data). Having disparate systems decreases visibility into your pipeline and finances, which often prevents lenders from achieving best price execution.

We can count on one hand the number of mortgage bankers that can tell us on a loan-by-loan basis what their cost to produce is. This indicates most mortgage bankers lack loan-level accounting detail and therefore visibility into which loans are the most profitable and why.

For example, the mortgage banking industry has historically been slow to adopt cutting-edge technology. In fact, most mortgage lenders use standalone systems as their mortgage loan origination system (LOS).

In other words, they have separate systems for accounting, payroll, human resources, customer relationship management (CRM), marketing, secondary marketing, hedging, risk management, quality control (QC) and servicing or interim servicing systems.

ERP takes all of these functions and creates an end-to-end, fully integrated enterprise system. Integration enables companies to streamline employees’ workloads, which increases productivity and efficiency. Having a fully integrated end-to-end enterprise system allows all processes to be fluid with less error, leading to more closed loans and higher profit margins.

2. ERP Improves Loan Processes

Before embarking on an ERP implementation, lenders should first improve the business processes of the entire organization by focusing on business process reengineering. This is important because most lenders have a patchwork of manual processes, causing inefficiency and an inability to detect and reduce risk in their lending operations.

Although an ERP system streamlines loan process and reduces manual entries, loan processes should first be documented and improved according to industry best practices. However, it is not possible to deploy best practices in a “one-size fits all” manner because lending operations vary dramatically in structure and complexity.

This variation in lending operations is why it is important to work with an experienced consultant, like Panorama, who understands all facets of the lending industry and has worked with a variety of different lending enterprise structures. We can help design your lending operation for maximum efficiency before guiding you in ERP selection.

3. ERP Optimizes Accounting Operations

There are many different ERP systems with powerful accounting suites, and these are among the most mature modules for many lenders.

A good ERP accounting module includes the following features:

- General ledger functionality

- Income analysis

- Expense analysis

- Liquidity analysis

- Profitability analysis

- Automated payroll

- Budgeting

- Financial reconciliation

- Investments

- Loan and warehouse interest calculations

- Hedging costs and revenue

- Invoicing and servicing

A good ERP accounting module provides loan-level accounting detail that enables lenders to measure and manage the KPIs (key performance indicators) that matter most.

4. ERP Improves Data Management

ERP systems are rich with data analysis tools that allow you to generate extensive reporting and deploy data learning tools that provide predictive analytics.

Imagine being able to more accurately forecast your pipeline gestation periods and default risk! This would enable better pricing execution while minimizing pipeline fall-out risk and decreasing loan defaults.

Solid data management tools allow you to improve loan performance and overall lending platform performance. Further, better visibility into loan collateral and loan pools can improve relationships with entities providing primary funding facilities, such as investors and warehouse lenders.

5. ERP Optimizes Marketing Processes

Marketing done right in the lending cycle can give your business a huge competitive advantage. An ERP system helps you create effective strategies that catch customers’ attention, with the added benefit of analyzing effectiveness and strategy-related returns over time.

ERP’s marketing management capabilities help you design, implement and analyze your marketing strategies and techniques. Marketing ERP modules also can help you determine the best course of action with both new and tried-and-true campaigns and messaging.

In addition, these modules enable you to analyze ad expenses and returns as well as gauge overall effectiveness of a given campaign.

6. ERP Improves Secondary Marketing

Modern ERP systems can turbocharge a lender’s secondary marketing operations, having a significant impact on transactional efficiency and the lender’s bottom line.

For example, loan pricing applications can move a lender’s secondary marketing team from the dark ages of pouring over manually updated spreadsheets when determining final loan pricing for retail, wholesale, correspondent and institutional customers alike.

Loan pricing applications move teams from this scenario to the more ideal scenario of relying on real-time pricing engines powered by live credit market data feeds. These applications accomplish this by factoring in a myriad of different loan level pricing adjustors.

In other words, customized channel- and customer-specific rate sheets can be configured to update in real-time. This allows sophisticated lending operations to stay in-sync with every tick of the global credit markets. It then allows them to maximize profits and avoid losses from those nasty repricing events, like an immediate parallel shift in yield curves.

ERP applications for secondary marketing departments also enable lenders to achieve best price execution on loan sales. This is done by determining best price execution on single or “flow” loan sales. It can also be achieved by enabling efficient sale of loan production in “bulk” loan sales of pools of loans with common loan attributes that the system determines will achieve the best pricing.

The most sophisticated systems also have functionality that allows lenders who bifurcate their loan assets and servicing assets (servicing rights) to determine if they should sell their servicing rights to the same buyers as the loan assets or sell the servicing rights to different buyers for better price execution.

The system can even enable lenders to decide if they should retain the servicing rights for the lender’s internal servicing or subservicing platform based on a myriad of different inputs. These inputs are related to how the lender values servicing rights. The system considers factors such as assumptions about the lender’s own servicing operation costs and efficiencies, projected portfolio prepayment speed and credit defaults.

And did we mention that today’s secondary marketing ERP software can make the hedging process a snap? Hedging for lenders involves the purchase and sale of financial derivatives in capital markets. These transactions offset gains or losses in the value of the lender’s loan production pipeline or loan portfolio with the goal of locking in profits and preventing losses caused by price changes in the credit markets. Determining the optimal blend of derivatives to buy or sell to achieve these hedging goals on an ongoing basis is easy with modern day ERP technology.

7. ERP Improves Compliance

Regulatory compliance is typically one of the most burdensome topics for lenders and arguably one of the factors that significantly affects your cost per loan all the way from loan origination through loan servicing or sale into the secondary market.

We can all surely remember when, for example, mortgage lenders were simply doing post-closing audits on loan samples as required by the GSEs (Government-Sponsored Entities). Then, TRID (the Truth In Lending Act – Real Estate Settlement Procedures Act Integrated Disclosure) came along, putting any lender that produced an inaccurate disclosure at risk. This was followed by the new HMDA (Home Mortgage Disclosure Act) requirements, which made the burden of compliance on mortgage lenders even greater.

Mortgage loan quality is now a loan-by-loan event that a fully integrated ERP system can monitor from beginning to end, alerting management to events of non-compliance at any point throughout the process.

Lenders that do not enjoy the real-time visibility provided by such advanced compliance monitoring will soon find that relationships with their credit providers, investors and secondary market partners have deteriorated when compared to those lenders who have implemented fully integrated, modern ERP solutions.

This can have significant negative impacts on a lender’s operations and profitability – from less favorable credit terms on the lender’s primary funding facilities, to impaired pricing in the secondary market. It also impacts legal and regulatory costs and can lead to fines and fees or worse!

8. ERP Improves Loan Origination Processes and Customer Service

In today’s world, competition among lenders is fierce. Everyone is fighting for borrowers and loan originators. On any given day, other lenders can offer better pricing to borrowers, but not all lenders know the value of providing automated tools to loan originators to attract and retain the best talent.

Depending on a lending operation’s structure and business model, lenders who are looking to increase their lending volume can typically do so by adding additional loan origination staff, call centers, or wholesale or correspondent lending channels. At the end of the day, more loan originators and origination channels can result in more growth and profit as you leverage your infrastructure and achieve economies of scale within your lending organization.

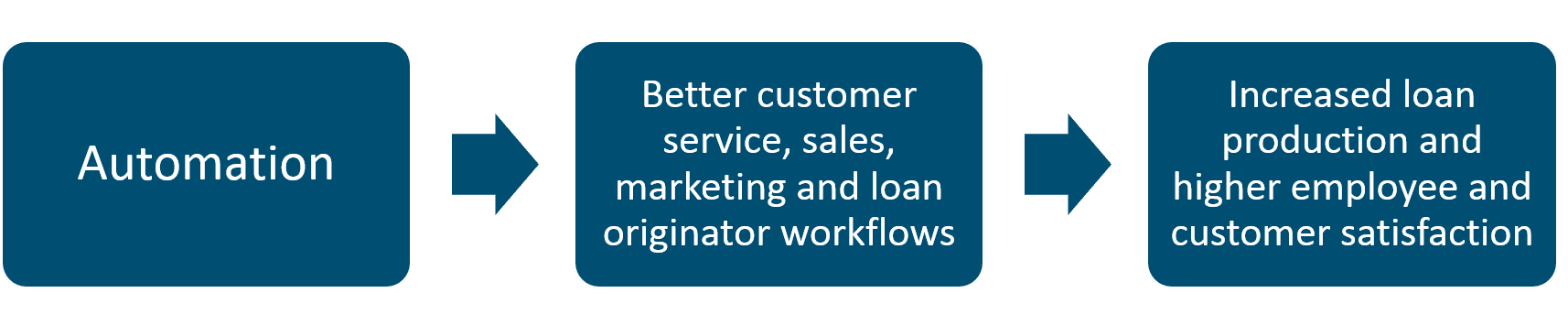

Today’s ERP systems makes this process easier by allowing for loan originators of all shapes and sizes to do more with less. Automated systems that manage customer information can greatly improve customer service, sales, marketing and loan originator workflows. This results in increased loan production and higher employee and customer satisfaction.

9. ERP Optimizes Loan Servicing

ERP provides extensive customer service management capabilities. From integrated call center automation to providing customers with online access to their accounts, ERP helps lenders create and integrate customer service functions with customer satisfaction analysis tools.

Here’s an example of the impact of ERP software combined with best-in-class business processes: A company breaks down siloed thinking to achieve operational efficiencies. This enables the company’s servicing department to alert loan originators and help them refinance borrowers at optimal times. Ultimately, this leads to mitigating the company’s portfolio run-off risk.

This may seem like a simple and common-sense practice, and while most of us in the MBA (Mortgage Bankers Association) discuss it extensively, a staggeringly high number of financial institutions, banks, non-bank lenders and servicers do not even bother with this function.

10. ERP Improves Organizational Culture

While culture is one of those “soft” business topics, it is arguably one of the most important. In lending businesses, culture is important in that lenders must operate as some of the most precise manufacturing operations. They must operate this way because every loan is a truly a unique person or business and potentially presents significant risk to the lender.

This need for precision means lenders often strive to achieve a delicate balance of customer service and due diligence for every loan originated and serviced.

Ethics play a major role in providing borrowers with information, such as loan program terms, that enable them to make informed decisions. This due diligence ensures that the lending process from origination through the sale or servicing of each loan is 100% above board.

With the right ERP system, many checks and balances can be built into your lending process to guarantee that your corporate culture values transparency to customers.

Automating Your Lending Operations

ERP enables lenders to easily streamline their business operations and lending processes, resulting in overall reduction of risk. This, in turn, maximizes profits as well as customer and employee satisfaction.

Every organization is different, and there is no perfect single solution that fits all lenders. Therefore, it is important to objectively assess how your business stacks up in terms of key performance indicators relative to other lenders in your market.

In other words, an ERP system alone is not the sole answer to transforming your lending business. After analyzing your current state performance and processes, you can start designing and moving toward an optimal future state.

There are many different ERP systems for lenders to evaluate, and most are very specialized. This is why it is important to work with an experienced ERP consultant with business transformation experience who understands all facets of the lending industry.

Look for someone who has worked with a variety of different lending enterprise structures and someone who can design your lending operation for maximum efficiency before looking at ERP systems.

Need a health or reality check on your lending operation? Looking for a sounding board that “gets it” when it comes to the lending business and lending solutions? Give Panorama Consulting Group a call and ask for Vanessa or Calvin – we love chatting about this stuff!

About Vanessa Davison, CMB

Vanessa co-founded several financial firms and served as a turnaround executive for three additional firms. She began her career 25 years ago, serving as President and CEO of a mortgage lending platform. She formulated and executed the corporate strategy successfully growing the organization from 36 employees to over 600 employees, while maintaining profit margins and diversifying the company’s sources of revenue within 36 months.

Her career has a rich history in the financial sector with many notable accomplishments in consumer and auto loans, small business loans and mortgage loans. She has worked for banks, credit unions, REITS, mortgage banks with call centers, retail, wholesale and correspondent channels. Vanessa successfully turned around CityMutual Financial by reworking the entire loan portfolio, restructuring operations and originations channels, which returned the company to profitability.

She is known in the industry for her strong acumen in lending origination, operations, compliance, underwriting, technology deployment and effective management of investors and warehouse lines. Due to her notable accomplishments in the industry, she lends her time serving as an instructor at the Mortgage Bankers Association’s School of Mortgage Banking.

She is a graduate from UC Berkeley and has completed advanced graduate programs at Harvard Business School and George Washington University.

About Calvin Hamler, AMP

Calvin is a former Wall Street finance professional turned entrepreneur, with proven results building and leading organizations of significant size, scale and complexity. He has managed both horizontal and vertical growth initiatives, and personally orchestrated and negotiated strategic mergers, acquisitions and joint ventures.

Prior to joining Panorama’s senior management team, Calvin started a de novo mortgage banking firm which grew to more than 600 employees generating $2.6 billion in financial asset production. He built an industry-leading capital markets trading operation at the heart of the firm, utilizing financial derivatives for pipeline and balance sheet hedging. During this time, he delivered the company’s loan production into the secondary market via bulk and forward sales, AoT (Assignment of Trade) and loan securitization.

Additionally, Calvin oversaw the firm’s IT staff in both the development of proprietary ERP systems and the selection and implementation of off-the-shelf ERP solutions. This ultimately orchestrated a joint venture with a startup software development firm to build proprietary middleware designed for the banking and financial services industries that is still widely used today.

Calvin is a Summa Cum Laude graduate, earning his degree in finance with emphasis in economics from the Daniels College of Business at the University of Denver. He has held a myriad of different securities licenses, including Series 7 General Securities Representative; Series 63 Uniform Securities Agent; Series 55 Equity Trader; and Series 24 General Securities Principal. Calvin is also a graduate of the Mortgage Bankers Association School of Mortgage Banking, having earned his AMP (Accredited Mortgage Professional) designation, and is a former board member of the Colorado Mortgage Lenders Association.